If you want to save money, the best way to find affordable quotes for Nissan Leaf insurance in New Orleans is to start doing a yearly price comparison from insurers who sell insurance in Louisiana. This can be done by completing these steps.

- Spend a few minutes and learn about auto insurance and the things you can change to lower rates. Many rating criteria that result in higher rates such as careless driving and an unacceptable credit history can be improved by being financially responsible and driving safely.

- Request price quotes from exclusive agents, independent agents, and direct providers. Exclusive agents and direct companies can give quotes from one company like GEICO or Allstate, while independent agencies can quote rates from many different companies.

- Compare the new rate quotes to your current policy and see if you can save money. If you can save money and switch companies, make sure there is no lapse in coverage.

A key point to remember is to make sure you enter identical deductibles and limits on each quote and and to compare as many companies as possible. This helps ensure a level playing field and a complete price analysis.

It’s safe to assume that insurance companies want to keep your business as long as possible. Consumers who shop for lower prices are highly likely to switch companies because of the good chance of finding a more affordable policy premium. A recent insurance study discovered that people who compared rate quotes regularly saved approximately $3,450 over four years compared to policyholders who never compared other company’s rates.

It’s safe to assume that insurance companies want to keep your business as long as possible. Consumers who shop for lower prices are highly likely to switch companies because of the good chance of finding a more affordable policy premium. A recent insurance study discovered that people who compared rate quotes regularly saved approximately $3,450 over four years compared to policyholders who never compared other company’s rates.

If finding the cheapest price for insurance in New Orleans is why you’re here, then learning about how to compare coverages can make it easier for you to save money.

The quickest method to get rate comparisons for Nissan Leaf insurance in New Orleans is to know most of the bigger providers have advanced systems to give free rates quotes. To get started, all you need to do is take a few minutes to give details like if it has an anti-theft system, what your job is, whether the vehicles are used for commuting, and if a SR-22 is needed. Your insurance information is then sent to multiple different insurance companies and they return rate quotes immediately.

If you wish to get multiple quotes for your Nissan Leaf now, click here and find out if lower rates are available in New Orleans.

The companies shown below have been selected to offer price quotes in Louisiana. If multiple companies are listed, we suggest you compare several of them in order to get a fair rate comparison.

Here’s why auto insurance is not optional

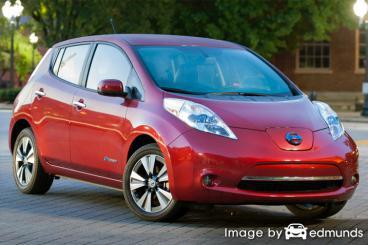

Even though it’s not necessarily cheap to insure a Nissan in New Orleans, insuring your vehicle may be required and benefits you in several ways.

First, almost all states have minimum liability requirements which means the state requires a minimum amount of liability insurance in order to drive the car. In Louisiana these limits are 15/30/25 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

Second, if you have a lien on your car, almost all lenders will force you to buy full coverage to guarantee payment of the loan. If you cancel or allow the policy to lapse, the bank or lender will purchase a policy for your Nissan for a lot more money and require you to reimburse them for the much more expensive policy.

Third, auto insurance protects not only your Nissan but also your assets. It will also provide coverage for all forms of medical expenses for you, any passengers, and anyone injured in an accident. As part of your policy, liability insurance will also pay attorney fees if you cause an accident and are sued. If mother nature or an accident damages your car, comprehensive and/or collision insurance will pay to have it repaired.

The benefits of carrying enough insurance more than offset the price you pay, especially when you need to use it. On average, a vehicle owner in New Orleans is currently overpaying as much as $830 a year so it’s recommended you shop around at least once a year to be sure current rates are still competitive.

Get Cheap Insurance Premiums by Understanding These Factors

Many factors are used when you get a price on insurance. Most are fairly basic such as traffic violations, but other criteria are not as apparent like your continuous coverage or how financially stable you are. A large part of saving on insurance is knowing the rating factors that aid in calculating the price you pay for insurance. When consumers understand what controls the rates you pay, this empowers consumers to make smart changes that can earn you better insurance rates.

The factors shown below are some of the things companies use to determine your rates.

Driving citations increase prices – Whether or not you get tickets has a big impact on rates. Only having one driving citation may increase your cost substantially. Drivers who don’t get tickets receive lower rates than people who have multiple driving citations. Drivers with severe citations like reckless driving or DUI may find that they have to to file a proof of financial responsibility form (SR-22) with the DMV in their state in order to legally drive a vehicle.

Having a spouse is a good thing – Walking down the aisle can actually save you money when shopping for insurance. It may mean you are more responsible and statistics prove married drivers tend to have fewer serious accidents.

More policies can equal more savings – The majority of insurance companies allow lower prices to policyholders that buy multiple policies, otherwise known as a multi-policy discount. The discount can add up to 10 percent or more. Even though this discount sounds good, it’s still a good idea to compare other New Orleans Leaf insurance rates to guarantee you are still saving the most.

Liability coverage – The liability section of your policy provides coverage if ever you are ruled to be at fault for damages from an accident. Liability insurance provides for a legal defense up to the limits shown on your policy. Liability is cheap compared to other policy coverages, so do not cut corners here.

Battle of the sexes – Statistics show that women are safer drivers than men. That doesn’t necessarily mean that men are worse drivers. Both genders cause auto accidents in similar numbers, but the male of the species tend to have higher claims. Not only that, but men also get ticketed for serious violations such as DWI and reckless driving.

Loss statistics for a Nissan Leaf – Auto insurance companies take into consideration historical loss data for every vehicle to calculate a rate that will offset any claims. Vehicles that historically have increased claim numbers or amounts will have a higher cost to insure.

The table below demonstrates the loss history for Nissan Leaf vehicles. For each policy coverage type, the claim probability for all vehicles combined as an average is considered to be 100. Values that are under 100 suggest a better than average loss history, while numbers above 100 point to more frequent losses or an increased probability of a larger loss.

| Vehicle Make and Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Nissan Leaf Electric | 89 | 84 | 45 | 83 | 64 | 76 |

Data Source: iihs.org (Insurance Institute for Highway Safety) for 2013-2015 Model Years

Save a ton by getting discounts

Auto insurance companies don’t list every available discount very well, so we researched both the well known and also the more inconspicuous credits available to bring down your rates.

- 55 and Retired – Drivers that qualify as senior citizens are able to get a small decrease in premiums.

- Policy Bundle Discount – If you have multiple policies with one company you may earn up to 20% and get you cheaper Leaf insurance.

- Club Memberships – Affiliation with a professional or civic organization could earn you a nice discount on your policy.

- Service Members Pay Less – Being on active deployment in the military can result in better rates.

- E-sign Discounts – Some auto insurance companies may give you up to $50 get New Orleans auto insurance over the internet.

- Pay Now and Pay Less – If you pay your bill all at once instead of monthly or quarterly installments you could save up to 5%.

- Save with More Vehicles Insured – Purchasing coverage when you have multiple vehicles with the same auto insurance company may reduce the rate for each vehicle.

- Drivers Education – Have your child enroll and complete driver’s education if offered at their school.

Don’t be surprised that many deductions do not apply to the overall cost of the policy. Most only reduce the cost of specific coverages such as comp or med pay. So even though it sounds like having all the discounts means you get insurance for free, companies don’t profit that way.

Some companies that may have these discounts are:

Check with each company the best way to save money. Savings may not be available in New Orleans. To see a list of insurers offering auto insurance discounts in New Orleans, click here.

Buying from car insurance agents

Many people prefer to visit with an insurance agent and we recommend doing that Good agents can make sure you are properly covered and will help you if you have claims. A good thing about comparing insurance prices online is you can get the best rates and still have a local agent.

To help locate an agent, after submitting this short form, your information is submitted to local insurance agents who will give you bids to get your business. It makes it easy because there is no need to search for an agent since price quotes are sent directly to you. In the event you want to compare prices for a specific company, don’t hesitate to navigate to their website and submit a quote form there.

To help locate an agent, after submitting this short form, your information is submitted to local insurance agents who will give you bids to get your business. It makes it easy because there is no need to search for an agent since price quotes are sent directly to you. In the event you want to compare prices for a specific company, don’t hesitate to navigate to their website and submit a quote form there.

Choosing an insurance company needs to be determined by more than just a cheap quote. These questions are important to ask:

- How often do they review coverages?

- If your car is in the repair shop, do you have coverage for a rental car?

- Will a damage claim use OEM or aftermarket replacement parts?

- Where would glass claims be handled in New Orleans?

- Which companies do they recommend if they are an independent agency?

- Are they able to influence company decisions when a claim is filed?

If you prefer to buy auto insurance from local New Orleans agents, you need to know there are two types of insurance agents and how they function. Auto insurance agents in New Orleans can be categorized as either exclusive or independent agents depending on their company appointments. Either can insure your vehicles, but it’s important to know the subtle differences since it can impact buying decisions.

Exclusive Agencies

Agents of this type normally can only provide a single company’s rates such as State Farm, Allstate, or Farmers Insurance. Exclusive agents cannot place coverage with different providers so if the price isn’t competitive there isn’t much they can do. These agents are well schooled on their products and sales techniques which helps them sell insurance even at higher premiums.

The following are exclusive insurance agents in New Orleans that are able to give rate quotes.

Derek Morel – State Farm Insurance Agent

5555 Bullard Ave #104 – New Orleans, LA 70128 – (504) 247-9241 – View Map

Allstate Insurance: Kenneth Taylor

7037 Canal Blvd #201 – New Orleans, LA 70124 – (504) 283-9310 – View Map

Allstate Insurance: Daniel Occhi

4006 Canal St – New Orleans, LA 70119 – (504) 517-9080 – View Map

Independent Insurance Agents

Agents that choose to be independent are not limited to a single company and that is an advantage because they can write policies with an assortment of companies and help determine which has the cheapest rates. If prices rise, an independent agent can move your coverage and the insured can keep the same agent.

When comparing rate quotes, you will definitely want to get some free quotes from several independent insurance agents so that you have a good selection of quotes to compare.

Below is a short list of independent agencies in New Orleans who can help you get price quote information.

Whitney Insurance Agency

650 Poydras St Suite 1500 – New Orleans, LA 70130 – (504) 581-5353 – View Map

Martin Insurance Agency, Inc

4700 Orleans Ave – New Orleans, LA 70119 – (504) 486-6133 – View Map

First Insurance, Inc.

First Bank and Trust Building, 909 Poydras St #2260 – New Orleans, LA 70112 – (504) 322-4927 – View Map

In Summary

Cheap Nissan Leaf insurance in New Orleans is available on the web and with local New Orleans insurance agents, so you should be comparing quotes from both in order to have the best chance of saving money. Some car insurance companies may not offer internet price quotes and usually these smaller providers work with independent agencies.

When shopping online for car insurance, never buy poor coverage just to save money. There have been many cases where an insured cut comprehensive coverage or liability limits to discover at claim time they didn’t have enough coverage. The ultimate goal is to find the BEST coverage at the best possible price, but do not sacrifice coverage to save money.

Additional articles

- Shopping for a Safe Car (Insurance Information Institute)

- Who Has the Cheapest New Orleans Car Insurance Rates for a School Permit? (FAQ)

- Who Has Cheap Car Insurance Quotes for a Dodge Grand Caravan in New Orleans? (FAQ)

- Who Has the Cheapest Auto Insurance Rates for Safe Drivers in New Orleans? (FAQ)

- Reducing Your Risks in a Car Crash Video (iihs.org)

- Alcohol Impaired Driving FAQ (iihs.org)

- Self-driving cars won’t replace humans (Insurance Institute for Highway Safety)