If you want to save money, the best way to get the cheapest auto insurance rates is to make a habit of regularly comparing prices from companies in New Orleans. You can compare rates by completing these steps.

If you want to save money, the best way to get the cheapest auto insurance rates is to make a habit of regularly comparing prices from companies in New Orleans. You can compare rates by completing these steps.

- Try to understand the different coverages in a policy and the measures you can control to prevent rate increases. Many rating criteria that cause rate increases like traffic citations, accidents, and a less-than-favorable credit score can be eliminated by making minor driving habit or lifestyle changes. This article provides more ideas to help find cheaper rates and find missing discounts.

- Compare price quotes from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can give quotes from a single company like GEICO and State Farm, while independent agencies can quote rates for a wide range of insurance providers.

- Compare the new quotes to your existing rates and determine if there is any savings. If you can save some money and switch companies, make sure there is no coverage gap between policies.

- Notify your agent or company to cancel the current policy and submit payment and a completed application to your new insurance company. As soon as coverage is bound, safely store the proof of insurance certificate in an easily accessible location in your vehicle.

A good piece of advice is that you’ll want to compare similar limits and deductibles on each quote and and to get rates from as many companies as you can. This provides a level playing field and a thorough selection of prices.

Everyone knows that insurance companies don’t want their customers to go rate shopping. Drivers who compare other rates are likely to buy a new policy because they have good chances of finding a more affordable policy premium. Surprisingly, a recent survey revealed that drivers who routinely shopped for cheaper coverage saved an average of $865 annually compared to those who don’t make a habit of comparing rates.

If finding the cheapest price for auto insurance in New Orleans is why you’re reading this, then knowing how to get free comparison quotes and analyze auto insurance can make the process more efficient.

Locating affordable policy in New Orleans is easy if you know what you’re doing. Nearly anyone who quotes auto insurance will more than likely find a cheaper policy. Nevertheless, Louisiana vehicle owners should learn how companies determine prices and use it to find better rates.

When comparison shopping, there are several ways to compare rate quotes from local New Orleans car insurance companies. The easiest way by far to compare rates consists of shopping online.

Comparing quotes online is fast and free, and it takes the place of having to drive to insurance agents’ offices. Shopping for car insurance online has reduced the need for local agents unless you’re the type of person who wants the professional assistance of a local agency. It is possible to price shop online but still have the advice of a local agent. When comparing car insurance rates, know that getting more free quotes increases your odds of finding the best rates.

The auto insurance companies shown below provide free rate quotes in New Orleans, LA. If you want to find cheap car insurance in New Orleans, it’s a good idea that you click on several of them in order to get a fair rate comparison.

Why you need to buy insurance

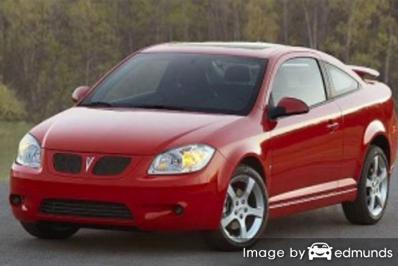

Despite the potentially high cost of Pontiac G5 insurance, insurance serves a purpose in several ways.

- Most states have mandatory liability insurance requirements which means you are required to carry specific limits of liability coverage in order to drive the car legally. In Louisiana these limits are 15/30/25 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If your vehicle has a lienholder, it’s guaranteed your bank will have a requirement that you have comprehensive coverage to protect their interest in the vehicle. If coverage lapses or is canceled, the lender may have to buy a policy to insure your Pontiac at an extremely high rate and require you to pay much more than you were paying before.

- Insurance preserves both your assets and your Pontiac G5. Insurance will pay for many types of medical costs for you, your passengers, and anyone else injured in an accident. Liability coverage will also pay attorney fees in the event you are sued. If you have damage to your Pontiac as the result of the weather or an accident, your insurance policy will pay to restore your vehicle to like-new condition.

The benefits of carrying enough insurance are definitely more than the cost, especially for larger claims. On average, a vehicle owner in New Orleans is overpaying more than $865 each year so compare rates each time the policy renews to ensure rates are inline.

Cheap Pontiac G5 insurance in New Orleans

Companies offering auto insurance don’t always list all possible discounts in a way that’s easy to find, so we took the time to find some of the more common in addition to some of the lesser obvious discounts that you can inquire about if you buy New Orleans car insurance online. If you’re not getting every credit possible, it’s possible you qualify for a lower rate.

- Renewal Discounts – Some insurance companies give discounts for switching companies before your current G5 insurance policy expires. The savings is around 10%.

- Accident-Free Discounts – Drivers with accident-free driving histories have much lower rates in comparison with insureds who have frequent claims or accidents.

- Accident Forgiveness – This one isn’t a discount, but some companies like Allstate and Progressive will forgive one accident without getting socked with a rate hike as long as you don’t have any claims for a particular time prior to the accident.

- Drivers Education – Make teen driver coverage more affordable by requiring them to take driver’s ed class if it’s offered in school.

- New Vehicle Savings – Putting insurance coverage on a new G5 can cost up to 25% less because newer models keep occupants safer.

- Auto/Life Discount – Companies who offer life insurance give a discount if you purchase some life insurance in addition to your auto policy.

- College Student Discount – Older children who are enrolled in higher education away from home without a vehicle on campus may be able to be covered for less.

- Anti-lock Brake Discount – Cars, trucks, and SUVs equipped with ABS or steering control can reduce accidents and earn discounts up to 10%.

- Low Mileage Discounts – Fewer annual miles on your Pontiac could qualify for slightly better car insurance rates than normal.

Remember that some credits don’t apply to all coverage premiums. Most only apply to individual premiums such as comp or med pay. So even though it sounds like adding up those discounts means a free policy, nobody gets a free ride.

To locate insurance companies with significant discounts in Louisiana, follow this link.

Different people need different auto insurance coverages

When it comes to buying adequate coverage for your personal vehicles, there really isn’t a one-size-fits-all type of policy. Every insured’s situation is different and your policy should reflect that.

These are some specific questions could help you determine if you may require specific advice.

- How much liability insurance is required?

- Is my custom paint covered by insurance?

- Is other people’s property covered if stolen from my vehicle?

- Am I covered when renting a car or should I buy coverage from the car rental agency?

- Does rental coverage apply when I am renting a car?

- Is my camper covered by my car insurance policy?

- Do all my vehicles need collision coverage?

- If my car is totaled with they pay enough to replace it?

If it’s difficult to answer those questions but you know they apply to you then you might want to talk to a licensed insurance agent. To find lower rates from a local agent, fill out this quick form or you can go here for a list of companies in your area.

Which car insurance company is best in New Orleans?

Buying coverage from a highly-rated insurance provider is difficult considering how many choices drivers have in New Orleans. The company ratings displayed below could help you select which car insurance companies to look at comparing rates with.

| Company | Value | Customer Service | Claims | Customer Satisfaction | A.M Best Rating | Overall Score |

|---|---|---|---|---|---|---|

| Travelers | 93 | 98 | 99 | 88% | A++ | 95.1 |

| USAA | 83 | 99 | 100 | 91% | A++ | 94.1 |

| Mercury Insurance | 97 | 96 | 88 | 89% | A+ | 93.4 |

| AAA Insurance | 91 | 95 | 92 | 90% | A | 93.3 |

| Nationwide | 85 | 95 | 97 | 89% | A+ | 92.4 |

| Allstate | 77 | 100 | 97 | 88% | A+ | 90.7 |

| State Farm | 80 | 94 | 96 | 88% | A++ | 90.6 |

| The Hartford | 88 | 93 | 91 | 87% | A+ | 90.4 |

| Safeco Insurance | 91 | 95 | 85 | 88% | A | 90.2 |

| Progressive | 88 | 94 | 83 | 88% | A+ | 90.1 |

| American Family | 91 | 86 | 95 | 83% | A | 89.7 |

| Esurance | 86 | 90 | 94 | 90% | A+ | 89.5 |

| The General | 86 | 93 | 89 | 84% | A- | 88.2 |

| GEICO | 79 | 89 | 95 | 87% | A++ | 87.8 |

| Titan Insurance | 86 | 82 | 92 | 86% | A+ | 86.5 |

| 21st Century | 86 | 82 | 90 | 84% | A | 86.4 |

| Liberty Mutual | 79 | 87 | 95 | 78% | A | 85.3 |

| Farmers Insurance | 77 | 80 | 80 | 84% | A | 80.3 |

| Compare Rates Now Go | ||||||

Data Source: Insure.com Best Car Insurance Companies